Shareholders of the Zurich-listed skincare company Galderma Group AG have secured approximately SFr 2.6 billion through a sale of an 8.4 per cent stake via accelerated book-building, making it the largest secondary share placement since the firm’s IPO. The sale by the consortium led by the private-equity house EQT AB along with the Abu Dhabi Investment Authority and Auba Investment Pte. Ltd. comes after the Swiss dermatology specialist raised about SFr 2.3 billion in its March 2024 listing.

This transaction follows the consortium’s disclosure that they continue to hold shares valued at roughly SFr 7.6 billion, thereby signalling both profit-taking and sustained confidence in Galderma’s future. The placement price was set at SFr 130 per share — a discount of around 6.9 per cent to the closing market price of SFr 139.70 prior to the sale announcement. The book-build covered some 20 million shares and was completed by Monday’s wall-crossing process.

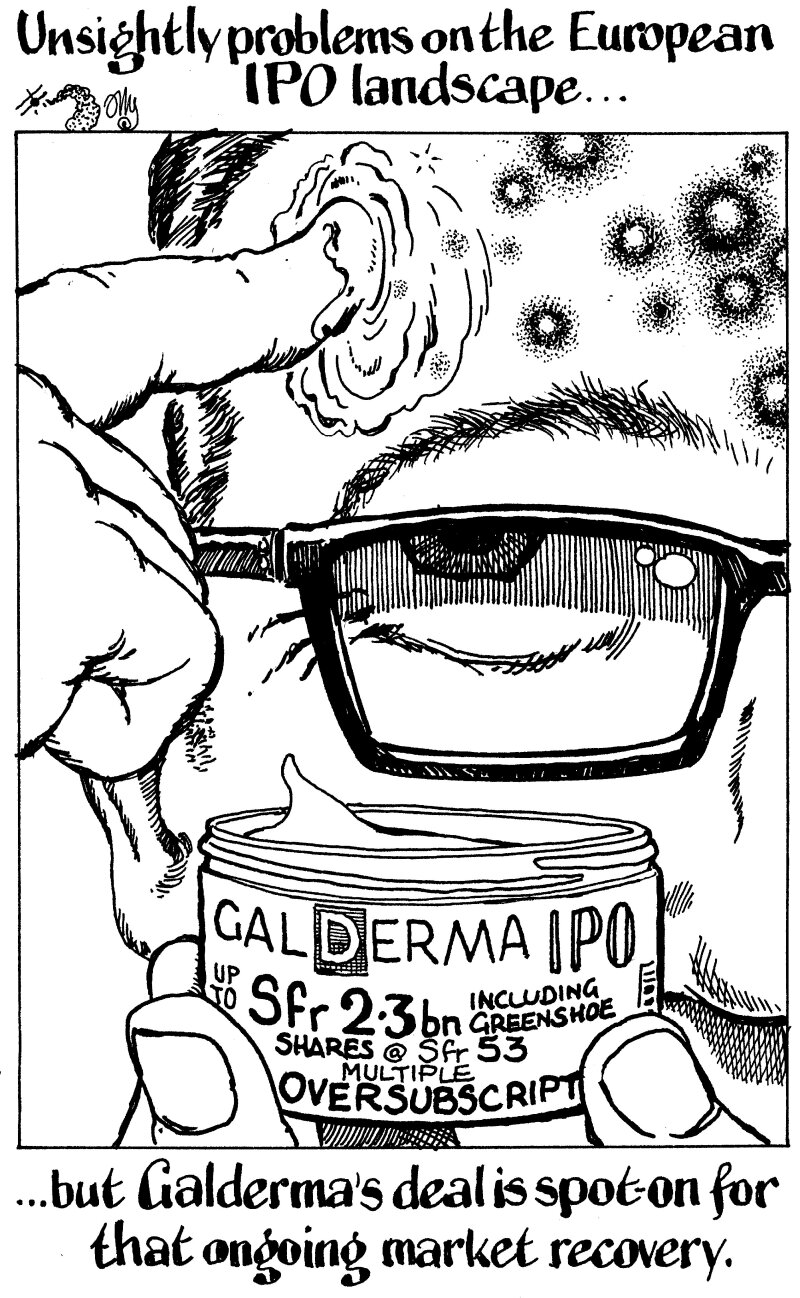

Galderma, headquartered in Zug, Switzerland, is a major player in the dermatology and medical aesthetics market, producing prescription dermatology treatments, skin-care brands and aesthetic injectables such as the Dysport product. The company listed on the SIX Swiss Exchange in March 2024 with backing from EQT, ADIA and Auba Investment among its major shareholders. The IPO valued the firm at over US$16 billion and was among Europe’s largest listings that year.

Industry analysts note that this latest sale by the consortium of existing shareholders comes amid strong investor interest in the global aesthetic and dermatology market, which is expanding as demand grows for wrinkle-reducing treatments, advanced skincare and prescription dermatology medicines. At the same time, Galderma’s shares slipped by around 2 per cent following the placement announcement, reflecting investor focus on the discount offered and the dilution effect of the share sale.

One factor shaping this deal is the strategic involvement of global beauty-industry major L’Oréal, which in August 2024 acquired a 10 per cent stake in Galderma for an undisclosed amount, in part to gain exposure to the fast-growing aesthetics segment while respecting Galderma’s autonomy. That deal had signalled L’Oréal’s renewed interest in the medical-aesthetic side of the business rather than its traditional pure-beauty focus.

From the backers’ perspective, the SFr 2.6 billion placement means that total gross proceeds from the listing and subsequent equity sales now approach SFr 12.54 billion, underscoring a liquid exit path and a high-value investment cycle for the consortium. The fact that they retain SFr 7.6 billion in holdings suggests they view further upside in Galderma’s growth potential — in particular in the clinical dermatology and injectables markets.

Notice an issue?

Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don’t hesitate to contact our editorial team at editor[at]thearabianpost[dot]com. We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity.