By Girish Linganna

The claim that China’s power is peaking is not new. For decades, there have been articles and books predicting that China’s rise is about to end and that its decline—or even collapse—is imminent. However, these predictions have always been wrong. Could this time be different? Let us examine the strongest arguments on both sides of this issue and come to a conclusion…

China’s exceptional rise over the past 40 years was the product of a unique set of circumstances that are unlikely to be repeated. These circumstances included a large and growing workforce, a low-cost manufacturing base and a favourable global economic environment. However, these tailwinds are now turning into headwinds, as China’s workforce is ageing, its manufacturing cost rising and the global economic environment becoming more uncertain. As a result, China’s economic growth is retarding .

China’s economic slowdown is a structural issue unlikely to be reversed in the near future. As China has become wealthier, its labour force has become more expensive, making it less attractive as a manufacturing hub. This trend was already underway before the Covid-19 pandemic and the lockdowns have only exacerbated the problem. As a result, China’s economic growth is likely to remain below its historical levels for the foreseeable future.

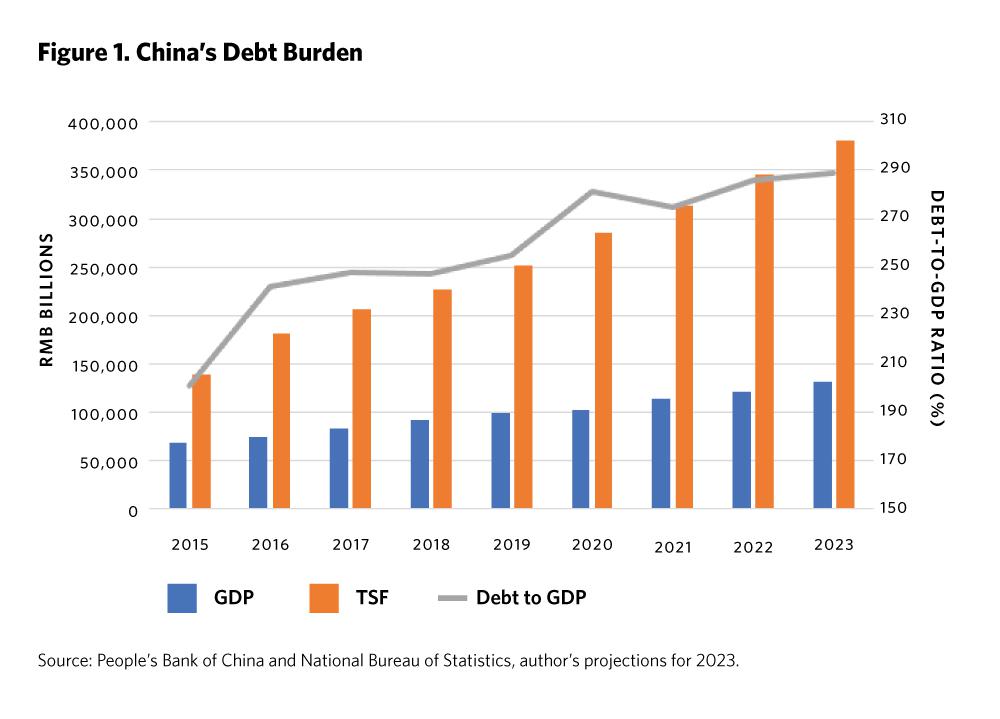

China’s economic growth has been slowing for a decade now, and the quality of that growth has deteriorated. Infrastructure has been overbuilt in an attempt to artificially boost growth, leading to the creation of dozens of ‘ghost cities’ that are devoid of people. This stimulus has been financed by an explosive debt bubble that the Chinese government has been reluctant to deflate.

Explosive debt bubble is a situation where a country has borrowed so much money that it is at risk of defaulting on its debt. This can happen when a government borrows too much money to finance its spending, or when businesses and individuals borrow too much money to finance their investments.

The Chinese government has been reluctant to deflate this debt bubble because it would cause a lot of economic pain. If the government were to stop borrowing money, it would have to cut spending, which would lead to job losses and a slowdown in economic growth.

The Chinese government is currently at the crossroads. It can either continue to borrow money and risk a financial crisis, or it can deflate the debt bubble and cause economic pain and hardship within the country. The government will need to decide which option is less risky.

China’s closed political system and President Xi Jinping’s statist economic preferences are hindering technological innovation, which is the most reliable engine of long-term growth. Although China’s research and development spending has increased significantly, the Chinese Communist Party’s increasingly heavy-handed interventions in the tech sector are stifling entrepreneurship and technological experimentation.

China has already lost many of its best and brightest minds, who have left the country for more welcoming environments, taking their talent and capital with them. This brain-drain is being compounded by Western export controls on semiconductors and other dual-use advanced technologies, which are further restricting China’s access to critical technologies. As a result, China’s tech capabilities are facing major binding constraints, which could have a significant impact on its long-term economic growth.

China is facing a demographic crisis that is unprecedented in peacetime. The country’s population peaked at 1.4 billion last year and is now in decline, due to an ageing population and plummeting birth rates. By 2035, China may stand to lose 70 million adults in the working age group, gaining 130 million senior citizens in the process. By 2100, the country’s population could be anywhere between 700 million and 475 million, with one in three Chinese citizens over the age of 65.

President Xi’s decision to end China’s one-child policy and then the two-child policy has not been enough to reverse the country’s demographic trends. In simpler terms, China’s government has tried to increase the number of babies being born by allowing couples to have more than one child. However, this has not been enough to reverse the country’s declining birth rate. The only way to significantly increase the number of births would be to allow more immigrants into the country, but the Chinese government is reluctant to do this. The fact that China’s demographic implosion has hit the country before it has had a chance to grow wealthy puts its economic and political future in all the more dire straits.

China is facing an increasingly hostile external environment. Proof of this can be evidenced in the USA’s unambiguous policy of containing China’s information and other technology sectors, besides China’s increasing strategic isolation in its own backyard. Japan and South Korea are increasing their defence spending. Taiwan is becoming more defiant. And new anti-China alliances, such as the Quad and AUKUS, are forming.

Relations between China and India have become more competitive in recent years due to a series of military clashes along their shared border. This has led India to draw closer to the US as it seeks to balance China’s growing clout in the region.

As China’s global footprint has expanded, so has anti-China sentiment. More than 10 countries have suspended, or cancelled, high-profile projects funded by the Belt and Road Initiative (BRI), a massive infrastructure project that has been criticized for its opaqueness and debt-trap diplomacy.

It is true that China is facing unprecedented challenges that make its continued growth more difficult. It is, therefore, possible that China will never surpass the US economically or become a global superpower. However, the question is whether China’s power has already peaked… And the answer to that question is ‘no’.

Although China’s economic growth has slowed in recent years, it is still growing faster than the US. This is to be expected, as China has already transitioned from a low-income country to a middle-income country in a relatively short period of time. The IMF has projected that China will continue to narrow the gap with the US in the coming decade reaching parity around 2030. Chinese labour costs remain significantly lower than in advanced industrial economies and China’s deep integration into global value chains means that any decoupling from the global economy will be slow and gradual, rather than abrupt and complete.

China’s economic growth has not been primarily driven by stimulus measures since the global financial crisis, with the exception of the Covid-19 reopening period. Infrastructure spending used to be unproductive, but fiscal reforms have imposed stricter profitability conditions. Although Beijing has delayed dealing with the country’s massive debt burden during the pandemic, the government remains committed to getting it under control.

Xi is ideologically committed to a statist economic agenda, which will likely slow down China’s economic growth. However, he also understands that he cannot stifle the private sector, especially the tech sector, which is one of the cornerstones of the Chinese economy. China continues to invest heavily in advanced technologies and it has already achieved parity with, or surpassed, the US in many fields, such as voice/facial recognition, smart infrastructure, telecommunications and electric vehicles. If artificial intelligence (AI) becomes the new commanding height of the global economy, as inevitably it will, China’s data advantage and strong AI talent pipeline will make it competitive, if not dominant.

China’s demographic challenge is real and massive, but it is not a near-term problem. Beijing has a number of tools at its disposal to delay the onset of this challenge, such as raising the retirement age. By bringing 40 million more people into the workforce by 2035, China can halve its demographic tax. This reform has already been flagged by Xi in his recent Party Congress report.

China’s educational system has recently received a significant boost in funding, which will lead to improvements in labour force quality in future. China can also boost productivity by increasing urbanization and moving workers out of low-productivity agriculture. These factors will give China at least 10-15 years to address the challenge of low birth rates.

China’s external environment has become more hostile, but there is no appetite for a new Cold War with Beijing. The US-China relationship is becoming more antagonistic, but both Biden and Xi want to avoid a full-blown rivalry. Biden’s containment policy is limited to narrow sectors deemed critical to national security and most US allies are not prepared to decouple economically from China. China remains the most important trade partner for most developing countries who are sympathetic to Beijing’s focus on economic development.

China’s diplomatic network is the largest in the world and its global soft power projection is just getting started. While many wealthy countries are becoming more hostile towards Beijing, the reality is that there are no feasible economic alternatives for much of the world. The US, all the while harping on decoupling from China, continues to sell record levels of its agricultural produce to China.

China is facing a dramatically more challenging domestic and global environment than it has in decades. The country is dealing with a demographic crisis, an increasingly hostile external environment and growing economic inequality. However, China still has substantial upside potential. The country’s economy is still growing at a relatively robust pace and its international influence is continuing to expand. While a ‘Chinese century’ may not be on the cards, China is likely to continue to grow and prosper in the decades to come. (IPA Service)

(The author is a Defence, Aerospace & Political analyst)

The post China’s Earlier High Growth Rate May Not Be Sustained, But Economy’s Potential Is Huge first appeared on IPA Newspack.