Polymarket, the world’s largest blockchain-based prediction market platform, is on the verge of completing a funding round exceeding $200 million that would value the company at over $1 billion. The strategic investment reflects growing investor confidence in forecasting platforms as tools for real-time insights and market intelligence.

The company, founded in 2020 by Shayne Coplan and headquartered in New York, has previously secured $70 million across Series A and B rounds led by General Catalyst, Founders Fund, alongside participation from Ethereum co-founder Vitalik Buterin. That capital helped Polymarket scale its operations offshore, particularly following regulatory setbacks in the United States, where it withdrew services under pressure from the Commodity Futures Trading Commission.

Sources indicate the new investment round will build on these foundations, raising upwards of $200 million and propelling Polymarket into unicorn status with a valuation north of $1 billion. Those close to the transaction describe a diverse syndicate of venture capital firms, strategic investors and high-profile figures from the crypto and financial sectors, though official names are yet to be disclosed.

Polymarket’s appeal lies in its novel combination of decentralised finance, crowd-sourced wisdom and smart contract automation. The platform allows participants to trade on real-world events—ranging from elections and policy outcomes to entertainment and economic indicators—by buying and selling shares reflective of outcome probabilities. Transactions occur using USDC on Polygon, ensuring on-chain settlement and transparency.

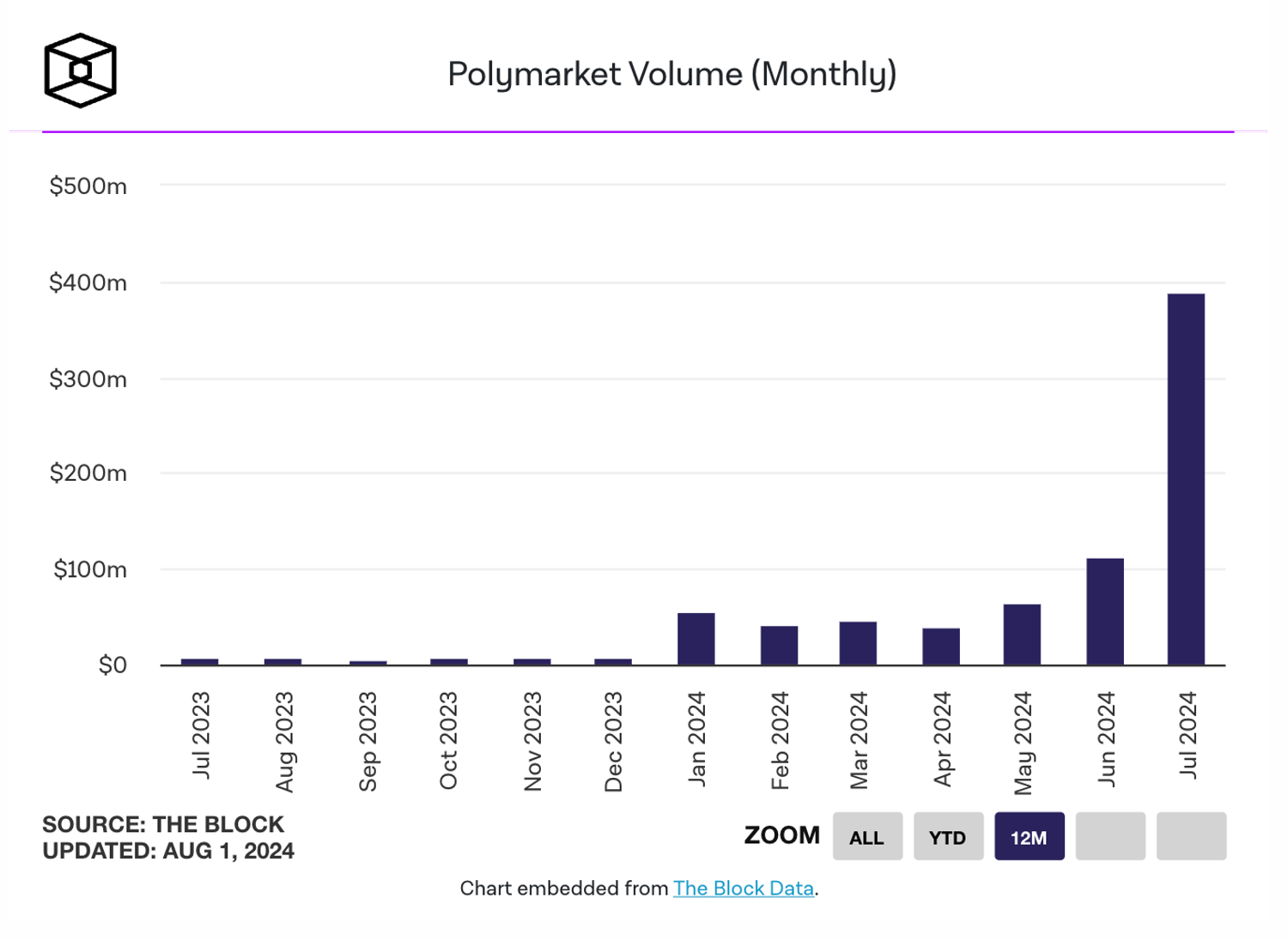

Trading volumes attest to the platform’s influence. In August 2024 alone, Polymarket processed approximately $472 million in trades, with political markets—especially those related to the US presidential election—accounting for nearly $1 billion in wagers by November 2024. Peter Thiel’s Founders Fund highlighted its trust in Polymarket’s market intelligence: “checking Polymarket when breaking news happens has become a habit”.

That compelling performance comes amid regulatory headwinds. Polymarket has barred US users since reaching a settlement with the CFTC in early 2022, which included a US$1.4 million fine and the appointment of former CFTC chairman J. Christopher Giancarlo to its advisory board. These changes aimed to address compliance concerns as the platform expanded internationally. More recently, the FBI reportedly raided Coplan’s home in autumn 2024 as part of an investigation into whether US-based activity violated these agreements.

Despite these challenges, Polymarket has continued to deepen its appeal. Ethereum co-founder Vitalik Buterin has publicly supported the broader application of prediction markets, terming them pioneers in “Info Finance,” an area he believes can enhance journalism, governance and scientific transparency. Polymarket’s data is now cited within Bloomberg’s Terminal services, offering institutional investors fresh analytical layers based on global betting dynamics.

The potential $200 million funding round is expected to include an allocation of token warrants enabling investors to participate in a future token issuance by Polymarket. Earlier reporting by CoinDesk and The Defiant in late 2024 highlighted a $50 million interim funding plan tied to a utility token offering, intended to integrate with or supplant the UMA oracle dispute-resolution system. That mechanism would allow users—or token holders—to validate market outcomes, an evolution that could expand Polymarket’s governance and on-chain autonomy.

Market observers view this token strategy as a logical advancement. Rising volumes and user engagement on election forecasts have revealed limitations in relying solely on external oracles; introducing a native token could decentralise verification and cement Polymarket’s position in the governance of its own markets.

Emerging trends suggest Polymarket is transitioning from an insurgent, crypto-native prediction exchange to a mainstream information infrastructure. Its user base now spans political analysts, financial professionals and retail traders. The recent partnership with X integrates Polymarket’s probabilistic feeds into social media dynamics, allowing users to access market sentiment in real-time alongside breaking news.

Yet questions over regulatory alignment remain. The CFTC is reportedly examining off-shore platforms that permit US bettor access, and lawmakers are considering broader prohibitions on event-based derivatives. The fallout from the 2024 FBI inquiry adds a layer of legal uncertainty, even as Polymarket navigates regulatory environments in Europe and Asia, where its platform has faced access restrictions from gambling regulators in Belgium, Poland, Singapore and France.

As Polymarket nears completion of its landmark funding round, it stands at a crossroads defined by opportunity and scrutiny. A valuation exceeding $1 billion would underscore investor conviction in its model, but unlocking the full potential of prediction markets may depend as much on regulatory clarity as on capital infusion.